If a mortgage foreclosure judgment was entered against you in the state of Florida, you could be among the many Floridians and ex-Floridians facing a mortgage deficiency collections case in a Florida court. The collection of mortgage deficiencies is on the rise in Florida and there are several things you should know if you are facing lingering mortgage liability.

Under Florida Statutes Section 702.06, a mortgage deficiency on a residential property in Florida is defined as the difference between the amount awarded to the bank in the final judgment of foreclosure and the fair market value of the home at the time of the court sale or short sale. As an example, assume that the Court has adjudicated that you owe $ 200,000 by virtue of your loan default and on the date of the court sale, your home has a fair market value of $ 110,000. Because the value of the property does not fully compensate the bank, the bank could attempt to obtain a deficiency judgment against you in the amount of at least $ 90,000, exclusive of attorneys’ fees and court costs.

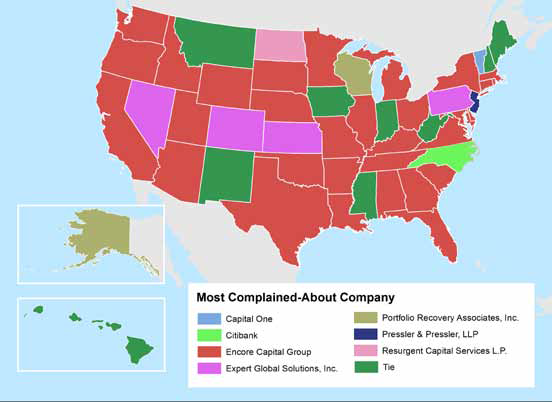

The recent trend among creditors is to package deficiency debt and sell the rights of collection to third party debt collectors. These collectors, while sometimes legitimate, often fail to comply with your rights under the Florida Consumer Collection Practices Act, Fair Debt Collection Practices Act, and the Telephone Consumer Protection Act. Unauthorized calls to your cell phone, harassing language, and false assertions of debt are just a few violations committed by these deficiency collectors that could entitle you to money and possibly provide leverage for a settlement.

In addition to gaining possible claims against the debt collector, it is also helpful to develop an overall strategy to solve the debt. LeavenLaw can assist you in planning a strategy that may include: contesting elements of the bank’s case, negotiating a possible settlement, monitoring for consumer law violations, or avoiding liability through bankruptcy.

If you are sued for a deficiency amount, it is a very serious situation that could result in garnishment of your money and property. To protect your interests you should seek out a firm experienced in settling deficiency debts. At LeavenLaw, we specialize in helping consumers analyze liability and strategize solutions to mortgage deficiencies. If you are facing a deficiency lawsuit, call LeavenLaw at (727) 327-3328 to setup a free consultation today or visit www.LeavenLaw.com.