Debt collection is a multi-billion dollar industry that directly affects approximately 30 million Americans, or 14% of the adult population. Among these 30 million people, the average debt subject to the collections process is approximately $1,400.00. Since the enactment of the Fair Debt Collect Practices Act (“FDCPA”) in 1977, the collection industry has experienced dramatic growth along with significant evolution in the business practices of debt collectors.

Debt collection is a multi-billion dollar industry that directly affects approximately 30 million Americans, or 14% of the adult population. Among these 30 million people, the average debt subject to the collections process is approximately $1,400.00. Since the enactment of the Fair Debt Collect Practices Act (“FDCPA”) in 1977, the collection industry has experienced dramatic growth along with significant evolution in the business practices of debt collectors.

Junk Debt Buying

One of the most significant changes in the debt collection industry is the advent and growth of junk debt buying. Junk debt buyers purchase defaulted debt from original creditors, for pennies on the dollar, and then seek to collect the alleged full amount for a remarkable profit. Junk debt buyers attempt to collect the defaulted debt by placing the debt with third-party collectors, reselling the alleged debt to other debt buyers, or by filing lawsuits against the consumer. All of these actions are taken despite the debt buyer’s inability to prove actual ownership of the account. Although over 500 junk debt buyers are currently active in the United States, the market is dominated by about 10 debt-buying firms who purchase the vast majority of the defaulted debts that are sold.

Another recent change in the debt collection industry is the explosive growth of medical debt collection. Medical debt is the third largest type of debt affecting consumers, behind only mortgages and auto loans. Moreover, hospitals and other medical and healthcare providers now hire debt collection agencies more often than any other industry.

In addition to medical debt collection, student loan debt collection is increasing at a fervent pace. Over the last decade, student loan debt has grown by over 33%. In fact, the average student who graduated in 2012 has $29,000.00 in student loan debt. Further, a growing number of student loan borrowers, greater than one in eight, have student loan debts of $50,000.00 or more.

Technology to Collect Debts

In addition to these changes, perhaps the greatest transformation in the debt collection industry – and one that is evolving since the enactment of the FDCPA – relates to the technologies that debt collectors and debt buyers use to communicate with consumers. The FDCPA governs communications via telephone, postal mail, and telegraph, but it does not necessarily contemplate the advent of the internet, smartphones, autodialers, fax machines, and social media. These technologies create new opportunities for debt collectors and debt buyers to communicate with consumers; however, challenges often arise when attempting to apply the FDCPA’s prohibitions to technologies that did not exist or were nascent at the time of its enactment. For example, debt collectors often now attempt to collect defaulted debt via Facebook, LinkedIn, and Twitter.

Who is Protecting the Consumer?

Who is Protecting the Consumer?

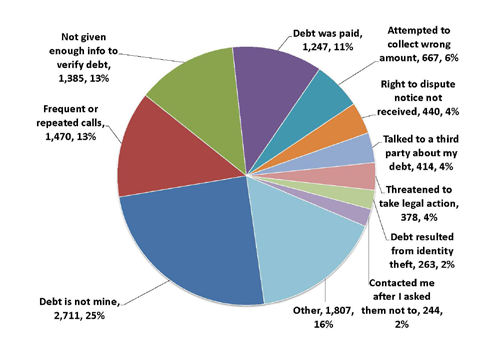

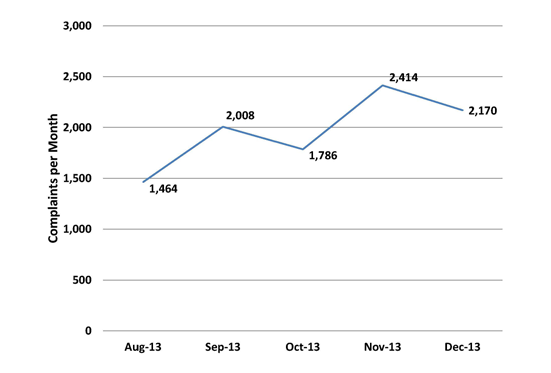

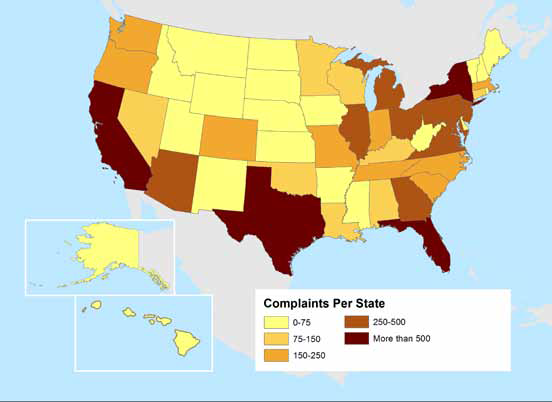

In response to the evolving landscape of debt collection, the Consumer Financial Protection Bureau (“CFPB”) came into existence in July 2011 as the first government agency solely dedicated to consumer financial protection. The CFPB is the first Federal agency with the authority to issue comprehensive rules regulating debt collectors and junk debt buyers. In 2013 alone, federal agencies received more than 200,000 complaints about the conduct of debt collectors and junk debt buyers, and the CFPB receives more complaints about debt collectors per month than any other source.

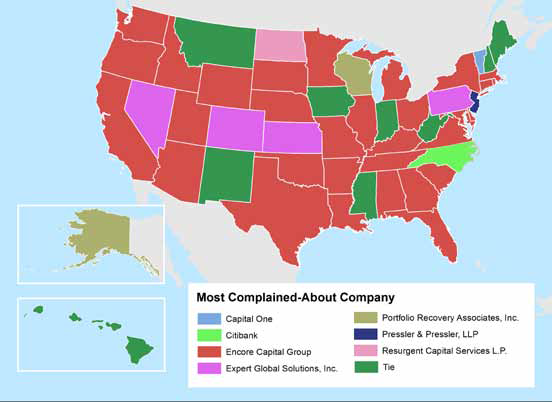

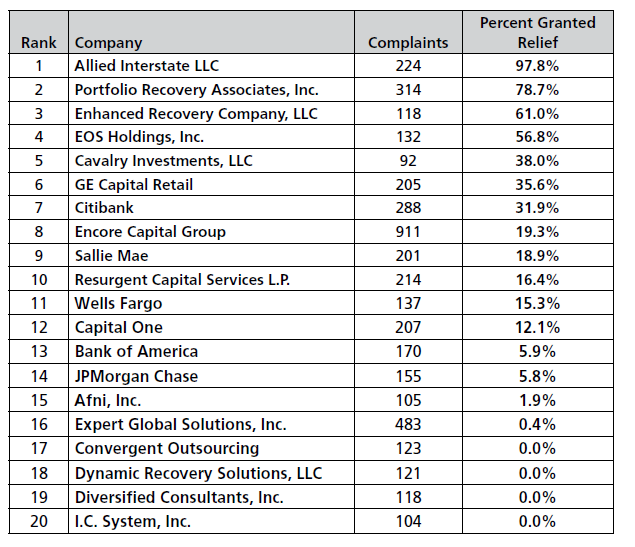

According to a 2014 report by the U.S. PIRG Education Fund, Encore Capital Group, a company that buys junk debts from banks, credit card companies, and other financial institutions, was the most complained about company by total number of complaints. Encore Capital Group was followed closely by Expert Global Solutions, Inc., Portfolio Recovery Associates, Inc. and Citibank in terms of total number of consumer complaints.

Complaints and Relief Granted

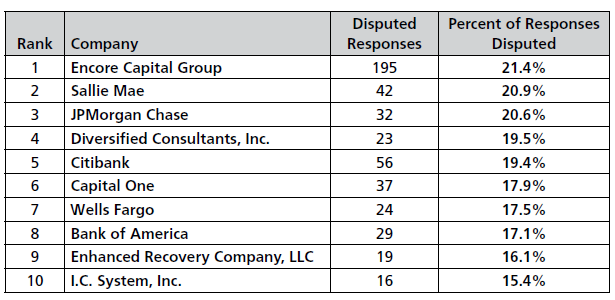

Companies vary greatly in the extent to which they respond to consumer complaints with offers of monetary or non-monetary relief. For example, four of the 20 most complained-about companies—Convergent Outsourcing, Dynamic Recovery Solutions, Inc., Diversified Consultants, Inc., and I.C. System, Inc.—reported providing no relief to any of the consumers who complained to the CFPB. Allied Interstate LLC and Portfolio Recovery Associates, Inc., on the other hand, were the most likely to report extending monetary or non-monetary relief to consumers, providing relief for 98 percent and 79 percent of complaints, respectively.

As the debt collection industry evolves, LeavenLaw will continue to evolve as well in our advocacy for consumer rights. If you have recently suffered from the abuse of a harassing creditor or debt collector, please feel free to contact LeavenLaw to consider your case at a free initial consultation. www.LeavenLaw.com 1-855-Leaven-Law (855-532-8365).

Gregory H. Lercher, Esq.