In the News

"If it’s war they want, then it’s war they shall have." O. Max Gardner III

On October 7, 2013, Attorney Ian R. Leavengood successfully completed an intensive four-day course (or Boot Camp) concentrating in Mortgage Fraud actions, Bankruptcy Discharge litigation, Credit Reporting violations and other issues related to assisting consumers emerging from a bankruptcy case. Run by the oft-quoted O. Max Gardner in North Carolina, Attorney Leavengood attended the Boot Camp with eight other consumer bankruptcy attorneys from around the country.

On October 7, 2013, Attorney Ian R. Leavengood successfully completed an intensive four-day course (or Boot Camp) concentrating in Mortgage Fraud actions, Bankruptcy Discharge litigation, Credit Reporting violations and other issues related to assisting consumers emerging from a bankruptcy case. Run by the oft-quoted O. Max Gardner in North Carolina, Attorney Leavengood attended the Boot Camp with eight other consumer bankruptcy attorneys from around the country.

Attorney Leavengood and his fellow trainees dissected 2,500+ documents including internal lender policies and SEC filings, learning the bank lingo, and "secret" codes and hidden risks found in the securitization of home mortgages, auto loans and common consumer credit card debts. Attorney Leavengood left the training as a proud and integral part of an elite national network of consumer bankruptcy attorneys armed with forms, letters, pleadings, articles and slides that show Gardner's Bankruptcy Litigation Model, which is designed to generate more economic benefits for the consumer and the attorney.

Attorney Leavengood and the other recruits also learned from Gardner's forensic accounting system how to identify predatory lending by going through real cases to understand codes, transaction histories and unlawful fees and charges. Before the trainees were finished, legal assistants provided "real time" demonstrations showing how Gardner's system operates with "real life" cases. This business model focuses on five laws that individually - and together, more potently - help consumers:

- Bankruptcy Code

- Fair Debt Collection Practices Act (FDCPA)

- Truth in Lending Act (TILA)

- Real Estate Settlement and Procedures Act (RESPA)

- Unfair or Deceptive Trade Practices (e.g., Florida Consumer Collection Practices Act (FCCPA)

Gardner told Business Week in the article "Bankruptcy Boot Camp," "My goal is to train an army of attorneys to take the fight right to the creditors and their Wall Street aiders and abettors. They wanted reform, and we're going to give it to them."

Mr. Gardner's Bankruptcy Boot Camp has been featured in Business Week and was recently the subject of a CNN segment on the show "Open Home" along with the director of the movie "Maxed Out."

“It is an honor and a privilege to serve in the elite army of consumer bankruptcy attorneys recruited and trained by O. Max Gardner to handle the difficult matters that have caused incredible hardship to the average consumer in today’s world,” said Attorney Leavengood.

LeavenLaw is a consumer litigation firm that has been helping Florida consumers with credit and debt since 1972. The attorneys at LeavenLaw have filed thousands and thousands of bankruptcies for consumers and are now taking the offensive, meeting creditors, debt collectors and mortgage servicers head-on to confront and stop unlawful debt collection. The result can be dramatic - settled debts, damages, loan modifications and attorneys’ fees paid by the offending creditor or debt collector.

"I am excited," commented Attorney Leavengood upon returning to St. Petersburg, Florida. "We have been using some of Max's strategies, but there is so much more to do. I feel armed, energized and ready to go."

Ian R. Leavengood is the founding and managing partner of LeavenLaw. He is AV® rated by Martindale-Hubbel® for his preeminent legal ability and ethics and has been selected as a Super Lawyer and a member of Florida Trend’s Florida Legal Elite.

If you are having problems with debt, mortgage, are seeking a loan modification or have credit reporting problems, please feel free to call LeavenLaw to schedule a free consultation to discuss your potential case, at (727) 327-3328, or visit the firm’s website at www.LeavenLaw.com.

Amelia Island, FL, July 18-21 2013

Richard M. Dauval, a partner at Leavengood, Dauval & Boyle, was honored with an invitation to speak at the American Bankruptcy Institute’s annual Southeast Bankruptcy Workshop on the topic of the Powers of the Chapter 7 Trustee: Carve-out, Sale of Assets and Short Sales in Chapter 7 http://www.abiworld.org/SE13/

The American Bankruptcy Institute's invitation to speak at the event was directly due to the work Mr. Dauval has been doing in representing Chapter 7 Trustees in the negotiation and sale of “under water” homes out of bankruptcy estates and via the bankruptcy court. Mr. Dauval’s work on these complicated real estate transactions drew the attention of one of the ABI event coordinators when she found herself representing a mortgage lender confused by Mr. Dauval’s work. Understanding that selling “under water homes” out of bankruptcy estates was an issue that spanned across the nation, the ABI believed it to be a topic of great interest to its members.

To date, Dauval has managed to sell these underwater properties, gaining money for the benefit of debtor's soon to be discharged creditors, as well as place what was a distressed property into the hands of a new, solvent, caring owner. This, in turn, helps communities and property values throughout the State of Florida.

If you or your client have questions about selling underwater properties -- either out of bankruptcy estates or through more traditional short sales -- please do not hesitate to contact Mr. Dauval at (727) 327.3328 or visit us online at www.LeavenLaw.com.

It was recently reported in the Tampa Bay Business Journal that bankruptcy filings in Central Florida totaled 47,513 for the fiscal year 2012. This is a drop of 16.6 percent from the previous year when Central Floridians filed 56,972 bankruptcies. The filling of business bankruptcies also declined for the fiscal year 2012; dropping by 18.7 percent.

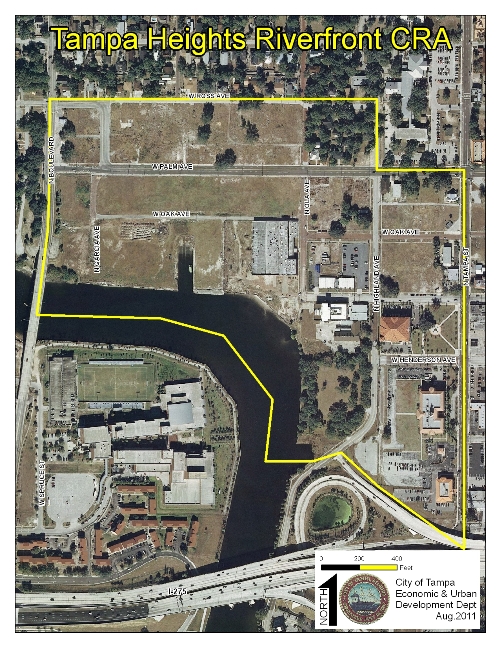

The Heights of Tampa was intended to be a mixed use residential and commercial real estate development just north of downtown Tampa until it fell victim to the real estate collapse of 2008. The development contemplated converting a large stretch of riverfront property, including an old trolley barn called the Tampa Armature Works Building, into a vibrant area for new restaurants and shops - and all with an amazing view of downtown Tampa.

As written about in the St. Petersburg Times on August 26, 2011, the project fell into Chapter 7 bankruptcy in mid-summer 2011. The project appeared dead … until now. The entity that owned the development – The Heights of Tampa, LLC—filed for Chapter 7 Bankruptcy protection on July 29, 2011, Case No. 8:11-bk-14608-MGW. The case was assigned to Leavengood, Dauval and Boyle, P.A. partner and Chapter 7 Bankruptcy panel Trustee, Richard M. Dauval.

As written about in the St. Petersburg Times on August 26, 2011, the project fell into Chapter 7 bankruptcy in mid-summer 2011. The project appeared dead … until now. The entity that owned the development – The Heights of Tampa, LLC—filed for Chapter 7 Bankruptcy protection on July 29, 2011, Case No. 8:11-bk-14608-MGW. The case was assigned to Leavengood, Dauval and Boyle, P.A. partner and Chapter 7 Bankruptcy panel Trustee, Richard M. Dauval.

“You never know where these large bankruptcy cases are going to go … you always hope for the best but you never know. I’m really excited we found a way to sell the Old Trolley Barn. That building has been around for over 100 years and it’s really falling apart. It’s great to know that [the Old Trolley Barn] has a chance to last another 100 years.”

From the court record it is noted that the auction of the Tampa Armature Works building took place on September 13, 2012. The record indicates that the property/building sold to Riverside Heights Holdings for $1.61 million. It is noted that Riverside Heights Holdings is one of the creditors of The Heights of Tampa.

It is unclear whether this signifies a new beginning for The Heights of Tampa or an entirely new project for the area.

After a career spent representing the people and companies that need to file bankruptcy, Richard Dauval has decided to sit on the other side of the table. A little over a year ago, Dauval was appointed to the Chapter 7 Bankruptcy Trustee Panel for the Middle District of Florida, Tampa Division. There are 17 trustees who sit on the panel, and between them, they administer all of the 3,000 Chapter 7 cases that are filed annually in the Tampa Division. See Trustee Locator

The play-by-play of Warren Sapp's 59-page bankruptcy filing

Excerpt from Tampa Bay Times Article By Michael Kruse, Times Staff Writer