In the News

GAINESVILLE, Fla. – LeavenLaw was named to the University of Florida’s 2017 Gator100 during a ceremony February 10th at University of Florida’s J. Wayne Reitz Union Grand Ballroom.

Sponsored by the UF Alumni Association, in partnership with the UF Entrepreneurship & Innovation Center, the Gator100 recognizes the 100 fastest-growing businesses owned or led by UF alumni. Ernst & Young calculated each company’s compounded annual growth rate (CAGR) over the past three years to generate the ranking.

LeavenLaw, a professional service based law-firm that generates revenue by the billable hour was remarkably able to rank in the top 100 Gator-founded or lead companies in the world with a compound annual growth rate (CAGR) of just under 25%.

LeavenLaw is a consumer litigation firm that represents consumers in disputes concerning debt, credit, personal injuries & accidents, as well as worker’s compensation and employment law claims throughout the Tampa Bay area and the state of Florida.

LeavenLaw has been recognized as one of the Best Law Firms in America® by U.S News & World Report for its collective efforts in helping tens of thousands of Floridians with consumer related  issues. Ian R. Leavengood, Esq., LeavenLaw’s Gator founder and Chief Executive Officer, has personally been recognized as one of the Best Lawyers in America®, is a SuperLawyer, a member of Florida’s Legal Elite, and received the A-V Rating from Martindale Hubbell for his skill and ethics in the practice of law. Leavengood graduated from the University of Florida with his Bachelors and Master Degrees in Accounting from the Fisher School of Accounting in 1995, and received his Juris Doctorate from the University of Florida Levin College of Law in 2000.

issues. Ian R. Leavengood, Esq., LeavenLaw’s Gator founder and Chief Executive Officer, has personally been recognized as one of the Best Lawyers in America®, is a SuperLawyer, a member of Florida’s Legal Elite, and received the A-V Rating from Martindale Hubbell for his skill and ethics in the practice of law. Leavengood graduated from the University of Florida with his Bachelors and Master Degrees in Accounting from the Fisher School of Accounting in 1995, and received his Juris Doctorate from the University of Florida Levin College of Law in 2000.

“Being recognized as one of the Gator100 is both a complete honor and a complete surprise. Starting out fifteen years ago, I wouldn’t have imagined we could help so many consumers through so many tough times with enough repeat success to achieve this honor,” said Leavengood. “It is a tribute to the attorneys and staff at LeavenLaw for all their hard work and dedication, succeeding in tough circumstances and many times against all odds.” When asked to put the Gator100 in perspective in his professional career, Leavengood thought for a moment and laughed. “Let’s just say as a business owner and entrepreneur, it’s my Heisman.”

“The Gator100 is a campus-wide initiative that recognizes the entrepreneurial spirit entrenched in the university,” said Timothy Walsh, the Executive Director of the UF Alumni Association and Assistant Vice President of Alumni Affairs. “UF Alumni have created and guided some of the most innovative and profitable businesses in the nation and world. The Gator100 celebrates the very best of our Gator Entrepreneurs.”

To qualify for the Gator100, companies must have been in business for five years or more as of October 1, 2016, and have had verifiable annual revenues of $250,000 or more in 2013. Additionally, a UF alumnus or alumna must have met one of the following three leadership criteria:

- Owned 50 percent or more of the company from Jan. 1, 2013, through Oct. 1, 2016;

- Served as company’s chief executive from Jan. 1, 2013, through Oct. 1, 2016; or

- Founded the company and been active as a member of the most senior management team from Jan. 1, 2013, through Oct. 1, 2016.

View the full list of Gator100 honorees at www.gator100.ufl.edu. To learn more about LeavenLaw, its services and how it can personally assist you, please visit www.LeavenLaw.com to learn more, or call 1-855-Leaven-Law to schedule a free initial consultation.

[module-359]

LeavenLaw recently sued Bright House/Spectrum and their parent company, Charter Communications, for allegedly unlawfully charging Florida consumers a Wi-Fi activation fee without a legitimate basis for doing so. More specifically, the class-action lawsuit alleges that Spectrum unlawfully charged former Bright House consumers with a $9.99 Wi-Fi “Activation Fee” even though all putative class members did not, in fact, activate any new Wi-Fi services.

As alleged in the class-action, the Plaintiffs and members of the class already had Wi-Fi service through Bright House Networks before Charter Communications purchased Bright House last year. Charter rebranded Bright House as Spectrum, and Charter informed all Bright House legacy customers that they would not experience any new charges to their Spectrum accounts. According to the lawsuit, however, Spectrum nonetheless charged the named Plaintiffs—and potentially hundreds or thousands of Florida consumers—the $9.99 “activation” fee.

WTSP Channel 10 News interviewed LeavenLaw Senior Associate, Aaron M. Swift, Esq., about the class-action lawsuit against Spectrum and Charter. In the interview, which can be viewed above, Swift states, “this type of situation is the hallmark situation where you have a business potentially systematically and routinely taking advantage of Florida consumers.”

If successful, the class-action lawsuit may entitle the class members to receive actual damages and up to $1,000.00 in statutory damages. LeavenLaw is committed to fighting on behalf of Florida consumers when businesses violate the law. If you or someone you know have been charged unlawful or illegitimate fees—whether by service providers, debt collectors, hospitals, or credit card companies—contact LeavenLaw today for a free consultation. For more information, visit www.leavenlaw.com or call 1-855-LeavenLaw today.

LeavenLaw Managing Partner Ian R. Leavengood has been selected by his peers for the third consecutive year for inclusion in The Best Lawyers in America©. Mr. Leavengood will appear in the 23rd Edition of The Best Lawyers in America© in Commercial Litigation. "It is an honor to again be selected to this prestigious group for a third straight year," said Leavengood. "It is really a tribute to my team and all the excellent consumer advocacy work that we collectively do that makes recognition like this possible."

In addition to helping small business owners in Commercial Litigation, the staff at LeavenLaw helps consumers with problems associated with debt and credit, through the firm's consumer credit and bankruptcy divisions.

Peer Reviewed

Inclusion in Best Lawyers in America© is based entirely on peer-review. The methodology is designed to capture, as accurately as possible, the consensus opinion of leading lawyers about the professional abilities of their colleagues within the same geographical area and legal practice area. Best Lawyers© employs a sophisticated, conscientious, rational, and transparent survey process designed to elicit meaningful and substantive evaluations of the quality of legal services.

Leavengood has also been named a Super Lawyer five times (twice as a Super Lawyer Rising Star), a member of Florida Trend magazine’s Florida Legal Elite, and has received an AV Rating from Martindale-Hubbell®.

By Aaron M. Swift, Esq.

According to Consumer Union, the policy and advocacy division of Consumer Reports, 1 in 3 consumers received medical bills substantially higher than expected in 2014. Often, these higher-than-expected medical bills result from “balance billing.”

What is balance billing?

When a medical provider agrees to be within an insurance network, the insurance network and provider negotiate fees for certain services in advance. Once a consumer receives said medical services, the provider bills the insurance company for the negotiated fee, and then the consumer is responsible for the co-pay and deductible, if applicable. Medical providers outside of network, however, can bill the consumer for the “full” amount of service, above and beyond the lower negotiated in-network rates. In that case, the out-of-network provider bills the insurance company and then “balance” bills the remainder to the consumer. This issue is especially common when a treating physician—for example an anesthesiologist or radiologist—is out-of-network but provides services within an in-network hospital. Emergency medical services also often result in balance billing as the consumer has less time and ability to determine if a physician or hospital is in network after or during an emergency.

What can I do to avoid balance billing?

Florida offers certain protections against balance billing; for example, under state law, out-of-network medical providers cannot balance bill HMO members for emergency services. Consumers with a PPO or other insurance plans, on the other hand, do not have the same protection. To avoid balance billing, check with any hospital or medical service provider, as well as your insurance, to confirm that they are in your network. Make sure to ask about everyone involved in the care, including specialists such as anesthesiologists.

What should I do if I am balance billed?

First, do not pay the bill right away. Make sure your insurance provider paid their portion of all bills, even to out-of-network providers. Be careful not to wait too long, however, as medical debts may be reported to your credit reports after 6 months, so you will want to avoid negative reporting and collections. Second, please contact a consumer lawyer at LeavenLaw, as we may be able to help settle the debt or identify unlawful balance billing. If the provider engaged in unlawful balance billing, you may be entitled to damages, and if we prevail in an unlawful balance billing lawsuit, the medical provider or debt collector may have to pay our attorneys’ fees and costs. You pay nothing unless we prevail. For more information, please visit www.LeavenLaw.com or call (727) 327-3328 for your free consultation.

By Ian R. Leavengood, Esq.

GAINESVILLE, Fla. – U.S. News and World Report released today its annual evaluation of the country’s top graduate programs, again ranking the University of Florida Levin College of Law the state’s best law school, a place it has held every year save one since the ranking originated. U.S. News ranked UF Law 24th among public law schools and tied for 47th overall, up two spots over last year. It ranked UF Law’s Graduate Tax Program first among public schools and tied with Georgetown for second overall, while the Environmental and Land Use Law Program was ranked seventh among public schools and 16th overall.

GAINESVILLE, Fla. – U.S. News and World Report released today its annual evaluation of the country’s top graduate programs, again ranking the University of Florida Levin College of Law the state’s best law school, a place it has held every year save one since the ranking originated. U.S. News ranked UF Law 24th among public law schools and tied for 47th overall, up two spots over last year. It ranked UF Law’s Graduate Tax Program first among public schools and tied with Georgetown for second overall, while the Environmental and Land Use Law Program was ranked seventh among public schools and 16th overall.

Judge Chris Nash, former LeavenLaw partner, prevailed in a landslide in his bid for re-election to the Hillsborough County bench in August. Judge Nash topped his opponent, Norman Cannella Jr., by a near 2 to 1 margin, gaining 65 to 35 percent of the vote in the August 26, 2014 election.

Judge Chris Nash, former LeavenLaw partner, prevailed in a landslide in his bid for re-election to the Hillsborough County bench in August. Judge Nash topped his opponent, Norman Cannella Jr., by a near 2 to 1 margin, gaining 65 to 35 percent of the vote in the August 26, 2014 election.

Governor Rick Scott appointed Nash to a judgeship last year, and Cannella Jr., a former Tampa prosecutor, announced his decision to run against Judge Nash only a few weeks into his tenure. Cannella Jr. has been in private practice since 2001, but his father, Norman Cannella Sr., is a widely-known and widely-respected name in the Tampa legal community.

Judicial elections in Florida are non-partisan; however, Cannella’s campaign engaged in political mudslinging by accusing Nash and Governor Scott of partisan favoritism. In fact, Cannella’s campaign sent out a mailer stating, “Does Rick Scott speak for YOU? Political appointments to the bench mean one thing…Political paybacks.” Nash’s campaign remained above the fray, and Nash himself worked hard to campaign with integrity and to be an excellent judge at the same time. In a lead-up to the election, in a Hillsborough Bar Association survey, 99 percent of responders stated that they either “highly approve” or “approve” of Judge Nash. His 99% approval rating is the highest ever received in a Judicial Preference Poll conducted by the Bar, and Judge Nash carried the momentum through the election in August.

Thank you to all of those who supported Judge Nash, and the LeavenLaw and Counsel for Life family will continue to support Judge Nash as he continues his bright future on the bench.

LeavenLaw Managing Shareholder Ian R. Leavengood was recently selected for inclusion into the 21st edition of The Best Lawyers In America© in the practice area of Litigation.

Inclusion in Best Lawyers is based entirely on peer-review. The methodology is designed to capture, as accurately as possible, the consensus opinion of leading lawyers about the professional abilities of their colleagues within the same geographical area and legal practice area. Best Lawyers employs a sophisticated, conscientious, rational, and transparent survey process designed to elicit meaningful and substantive evaluations of the quality of legal services.

Leavengood's inclusion in Best Lawyers continues his string of peer and client recognition for legal ability and ethics in his profession. "I am flattered to be recognized as one of the Bet Lawyers in America," said Leavengood when recently asked of his inclusion into the prestigious legal organization. "I will continue to try and serve my clients to the best of my ability and continue to earn the recognition that has been bestowed upon me."

Leavengood has also been named a SuperLawyer four times, a member of Florida's Legal Elite, and has received an A-V Rating from Martindale Hubbell. For more information regarding Mr. Leavengood's credentials, please visit his bio page.

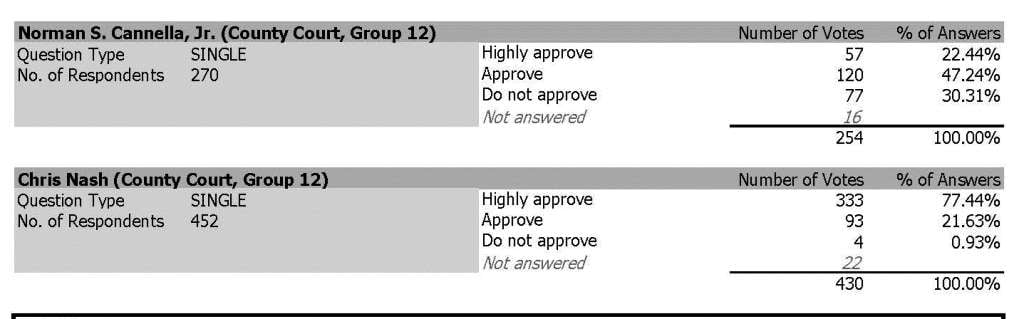

Former LeavenLaw Partner and current sitting Thirteenth Judicial Circuit County Judge, Chris Nash, recently received what is believed to be the highest overall approval rating from practicing attorneys in the Hillsborough County Bar Association (HCBA), both in terms of percentages and absolute overall votes.

Former LeavenLaw Partner and current sitting Thirteenth Judicial Circuit County Judge, Chris Nash, recently received what is believed to be the highest overall approval rating from practicing attorneys in the Hillsborough County Bar Association (HCBA), both in terms of percentages and absolute overall votes.

Judge Nash was appointed to the Judicial Bench in June 2013 by Governor Rick Scott. Due to the timing of his appointment, however, Judge Nash must seek election and is being opposed by attorney Norman Cannella, Jr. In his campaign, Judge Nash has procured the endorsements of almost all of the major Tampa Bay organizations that weigh in on such races, including but not limited to, David Gee, Hillsborough County Sheriff and Julianne M. Holt, Public Defender of Hillsborough County, along with many Public Safety and Labor Organizations including Tampa Fire Fighters Union and West Central Florida Federation of Labor. What is perhaps most impressive, however, is the approval rating he garners from those in the profession and practicing before him.

Judge Nash garnered 426 votes of Approval, with 333 for “Highly Approve” and only 4 for “Do not approve,” the highest and lowest in each respective category of all candidates. "I am excited to have the support and confidence of so many members of the Hillsborough County Bar," said Judge Nash when questioned about the polling results. "I hope to keep up this momentum through Election Day on August 26th."

Judge Nash's opponent, attorney Cannella, finished 11th out of the 12 judicial candidates evaluated by the HCBA, and received more votes disapproving of his efforts than approving. The election is August 26, 2014. Judge Nash appreciates all Hillsborough County voters support on Election Day. Please contribute to Judge Nash's campaign efforts at www.ChrisNashforJudge.com

On Wednesday, April 23, 2014, the American Tort Reform Association (“ATRA”) announced a “multiyear, multistate campaign” to reform state consumer-protection laws. However, by “reform,” the ATRA really means to scale back, water down, and weaken such laws.

On Wednesday, April 23, 2014, the American Tort Reform Association (“ATRA”) announced a “multiyear, multistate campaign” to reform state consumer-protection laws. However, by “reform,” the ATRA really means to scale back, water down, and weaken such laws.

The effect on consumers could be devastating, as such “reforms” could directly impact consumers’ ability to file lawsuits over misleading food labels, defective cars, and unlawful debt collection practices. Reform proponents, who openly represent big business and corporate interests, argue that the abuse of consumer-protection laws has actually harmed consumers by increasing product and service costs while inundating courts with frivolous claims. On the other hand, Peter Holland, a Maryland-based consumer lawyer who is an expert on the debt buying industry, warned that the corporate lobbyists are “basically creating a race to the bottom” and stated that such “reforms” would leave consumers vulnerable to hazardous products and sleazy marketing.

As a consumer protection firm that fights against big business and corporations every day, LeavenLaw is against any so-called “reform” that weakens consumer-protection rights. Some of the state laws that ATRA plans to attack are the very laws that LeavenLaw use to enforce our clients’ rights. For example, the ATRA plans to battle laws that require defendants to pay the consumer’s attorneys’ fees in the event that the consumer prevails in litigation against creditors and debt collectors. Such fee-shifting statutes allow consumer attorneys to file lawsuits against big corporations and banks in circumstances where the consumer obviously does not have thousands of dollars to fight big business and their corporate attorneys. If these laws are changed, including the FCCPA and FDCPA, then consumer-protection attorneys will no longer be empowered as private attorneys general to fight for the rights of ordinary consumers and citizens.

To that end, Ian Leavengood and Aaron Swift of LeavenLaw recently served on a committee that was instrumental in thwarting efforts that would have gutted the protections of the FCCPA for Florida consumers. Specifically, they helped shape the arguments as to why the FCCPA should not be amended to only apply to debt collectors. Now, as a result, the amendment will not include this change, and the FCCPA will continue to proscribe abusive and harassing conduct on the part of first-party creditors.

For more information about the ATRA’s efforts to weaken consumer-protection laws, or to learn more about LeavenLaw’s efforts to fight these so-called reforms, please visit www.leavenlaw.com or call (727) 327-3328.

What would you do if your house payment suddenly went up $500? What if it was through no fault of your own? That’s exactly what happened to one of our clients, Kurt Petersen. Because of an oversight by his mortgage company, his flood insurance premium was not paid on time. This would normally be an easy problem to remedy, but with the new Biggert-Waters Flood Insurance Reform Act now in effect, his premium will jump from $1,800 a year to over $8,000.

Sure, his premium would have increased anyway because his waterfront home in northeast St. Petersburg is in a flood zone, but only by 20 percent per year, up to the new higher non-subsidized rate.

Equally concerning about this oversight is that his home and its contents were not covered by flood insurance for most of the year. "My home was without flood insurance for 10 months, and it was supposed to be paid through the escrow," Petersen said.

Like many homeowners, Kurt Petersen’s property taxes and insurance premiums are paid through an escrow account managed by his mortgage company. These costs along with his mortgage principal and interest are bundled into his monthly mortgage payment.

The oversight seems to be a byproduct of refinancing his mortgage in 2012. An act that was intended to save money may end up costing Mr. Peterson much more. Peterson, a banker, calculates the difference between stair step increases and the immediate increase could add up to $50,000.

This is why Mr. Petersen has enlisted the services of LeavenLaw. Attorney Ian Leavengood states, "Review of Mr. Petersen's re-finance closing documents clearly demonstrates not only that flood insurance escrow was contemplated by Mr. Petersen's lender, Wells Fargo, but that Wells Fargo even charged Mr. Petersen on the closing statement for a company to monitor and verify that Mr. Petersen continually had flood insurance. Both Mr. Petersen's lender and Life of Loan Flood Policy Company completely failed Mr. Petersen, and as a result, he has been irreparably damaged."

Leavengood adds, "There's no negligence on the part of Mr. Petersen. He has made his payments in a timely manner and performed exactly how he was supposed to perform, and now he's at least potentially facing monetary damage."

Leavengood is hopeful that either the National Flood Insurance Program will agree Petersen did not intentionally allow his policy to lapse, or the escrow agent will absorb the costly error.

In either case, "Consumers just need to be very diligent," Leavengood advised. "They need to try to understand what this law means. You can't afford to let your flood policy lapse."

This case also illustrates how the flood insurance reforms impact local economies. The money to pay the higher premium will have to come from somewhere. "It means I'm not buying a new car," Petersen said. "I have a 1996 and a 2000, and one of them's gotta go soon."